About Solar panels that can be purchased on credit

The Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy propertyfor your home installed anytime from 2022 through 2032. The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034. You may be able to.

Qualified expenses include the costs of new clean energy propertyincluding: 1. Solar electric panels 2. Solar water heaters 3. Wind turbines 4. Geothermal heat pumps 5. Fuel cells.

You may claim the residential clean energy credit for improvements to your main home, whether you own or rent it. Your main home is generally where you live most of the time. The credit applies to new or existing homes.

Clean energy property must meet the following standards to qualify for the residential clean energy credit. Solar water heatersmust be certified by the Solar Rating Certification.Eligible equipment for the federal tax credit includes photovoltaic solar installations, battery storage, solar water heaters, geothermal pumps, fuel cells, and wind turbines.

Eligible equipment for the federal tax credit includes photovoltaic solar installations, battery storage, solar water heaters, geothermal pumps, fuel cells, and wind turbines.

If you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage technology, you may qualify for an annual residential clean energy tax credit.

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer. (Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance.).

Yes. Generally, you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house (assuming the builder did not claim the tax credit)—in other words, you may claim the credit in 2021.

When you purchase (not lease) new solar-powered equipment that generates electricity or heats water, or purchase solar power storage equipment, you generally can claim the Residential Clean Energy Credit to lower your tax bill.

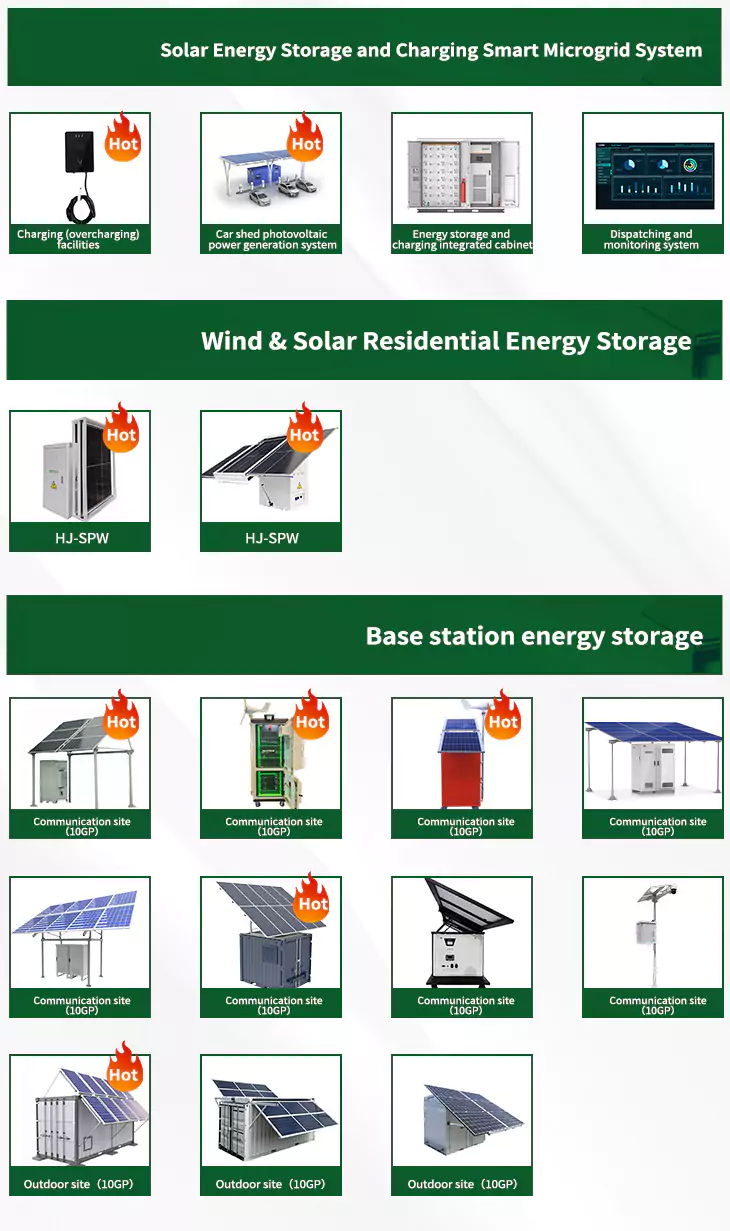

As the photovoltaic (PV) industry continues to evolve, advancements in Solar panels that can be purchased on credit have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Solar panels that can be purchased on credit for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Solar panels that can be purchased on credit featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

6 FAQs about [Solar panels that can be purchased on credit]

Do solar panels qualify for tax credit?

After installing solar panels, you can claim the tax credit on the IRS filing that corresponds to the year you installed your system. For example, a solar installation completed in June 2024 would generate a federal tax credit that the owner could claim in April 2025. Who Qualifies for the Federal Solar Tax Credit?

What is the federal solar tax credit?

What is the federal solar tax credit? • The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic (PV) system.2 (Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance.)

What is the Federal residential solar energy credit?

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer. (Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance.)

Can I claim a solar tax credit?

When you purchase solar equipment for your home and have tax liability, you generally can claim a solar tax credit to lower your tax bill. The Residential Clean Energy Credit is non-refundable meaning that it can offset your income tax liability dollar-for-dollar, but any excess credit won’t be refunded.

How much is a residential solar energy credit worth?

The residential solar energy credit is worth 30% of the installed system costs through 2032. 26% in 2033. 22% in 2034 and expires after that. What is the Residential Clean Energy Credit? In an effort to encourage Americans to use solar power, the US government offers tax credits for solar systems.

Can I get a tax credit for a solar PV system?

Under the ITC, the Internal Revenue Service (IRS) provides nonrefundable tax credits for energy improvement upgrades to your home or rental property, such as installing a solar photovoltaic (PV) system. The ITC was extended in 2022 thanks to the passage of the Inflation Reduction Act.

Related Contents

- Comparison between photovoltaic panels and PC solar panels

- Can solar photovoltaic panels be made

- How long and wide are solar panels

- Solar photovoltaic panels are transparent

- Photovoltaic panels solar energy auxiliary materials

- Photovoltaic solar panels damaged

- Price of three solar panels

- How many years can JA Solar s photovoltaic panels last

- Solar panels for off-grid power generation

- Basic knowledge of photovoltaic solar panels

- Do you charge for installing solar panels

- Typhoon blows away solar photovoltaic panels